COVID-19 Stimulus Package (subject to pending legislation)

Boosting Cash Flow for Employers

The Government is enhancing the ‘Boosting Cash Flow for Employers’ measure it announced on 12 March 2020. The Government is providing up to $100,000 to eligible small and medium-sized businesses, and not for-profits (NFPs) that employ people, with a minimum payment of $20,000. These payments will help businesses and NFPs with their cash flow so they can keep operating, pay their rent, electricity and other bills and retain staff.

This measure will benefit around 690,000 businesses employing around 7.8 million people, and around 30,000 NFPs (including charities).

Small and medium-sized business entities with aggregated annual turnover under $50 million and that employ workers, are eligible. NFPs, including charities, with aggregated annual turnover under $50 million and that employ workers will now also be eligible. This will support employment at a time where NFPs are facing increasing demand for services.

Under the enhanced scheme, employers will receive a payment equal to 100 per cent of their salary and wages withheld (up from 50 per cent), with the maximum payment being increased from $25,000 to $50,000. In addition, the minimum payment is being increased from $2,000 to $10,000.

An additional payment is also being introduced in the July – October 2020 period. Eligible entities will receive an additional payment equal to the total of the Boosting Cash Flow for Employers payments they have received. This means that eligible entities will receive at least $20,000 up to a total of $100,000 under both payments.

The measure initially provided up to $25,000 to business, with a minimum payment of $2,000 for eligible businesses. Small and medium sized business entities with aggregated annual turnover under $50 million and that employ workers are eligible.

This additional payment continues cash flow support over a longer period, increasing confidence, helping employers to retain staff and helping entities to keep operating. The cash flow boost provides a tax-free payment to employers and is automatically calculated by the Australian Taxation Office (ATO). There are no new forms required.

Eligibility

Boosting Cash Flow for Employers payments Small and medium sized business entities and NFPs with aggregated annual turnover under $50 million and that employ workers, will be eligible.

Eligibility will generally be based on prior year turnover.

- The payment will be delivered by the ATO as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements.

- Eligible employers that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 100 per cent of the amount withheld, up to a maximum payment of $50,000.

- Eligible employers that pay salary and wages will receive a minimum payment of $10,000, even if they are not required to withhold tax.

- The payments will only be available to active eligible employers established prior to 12 March 2020.

However, charities which are registered with the Australian Charities and Not-for-profits Commission will be eligible regardless of when they were registered, subject to meeting other eligibility requirements. This recognises that new charities may be established in response to the Coronavirus pandemic.

Eligibility – Additional payment

To qualify for the additional payment, the entity must continue to be active. For monthly activity statement lodgers, the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020, July 2020, August 2020 and September 2020 activity statements (up to a total of $50,000).

For quarterly activity statement lodgers, the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to half of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020 and September 2020 activity statements (up to a total of $50,000).

This measure will benefit around 690,000 businesses employing around 7.8 million people, and around 30,000 NFPs (including charities).

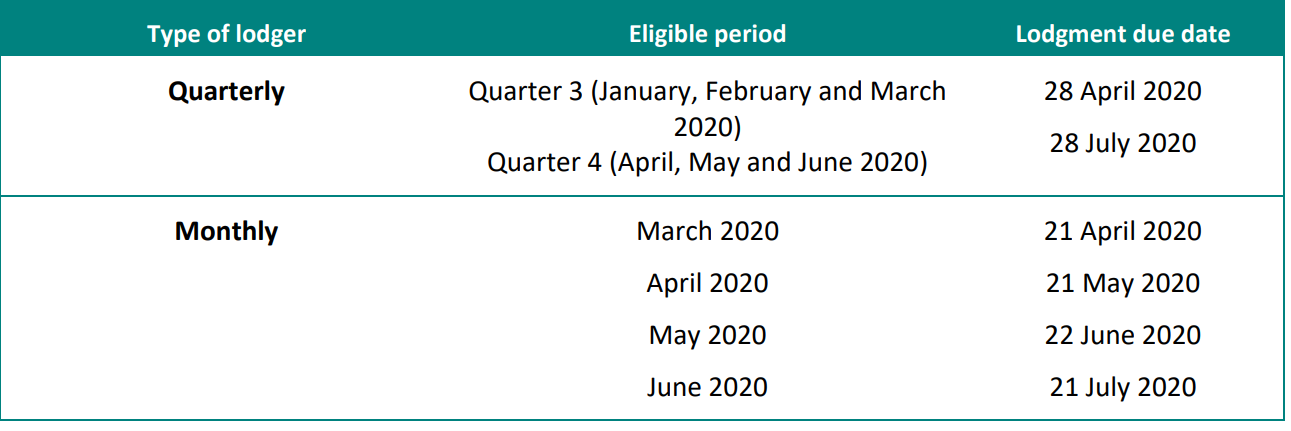

Timing – Boosting Cash Flow for Employers payments

The Boosting Cash Flow for Employers payment will be applied to a limited number of activity statement lodgments. The ATO will deliver the payment as a credit to the entity upon lodgment of their activity statements. Where this results in the entity being in a refund position, the ATO will deliver the refund within 14 days.

Quarterly lodgers will be eligible to receive the payment for the quarters ending March 2020 and June 2020. Monthly lodgers will be eligible to receive the payment for the March 2020, April 2020, May 2020 and June 2020 lodgments.

To provide a similar treatment to quarterly lodgers, the payment for monthly lodgers will be calculated at three times the rate (300 per cent) in the March 2020 activity statement. The minimum payment will be applied to the entities’ first lodgment.

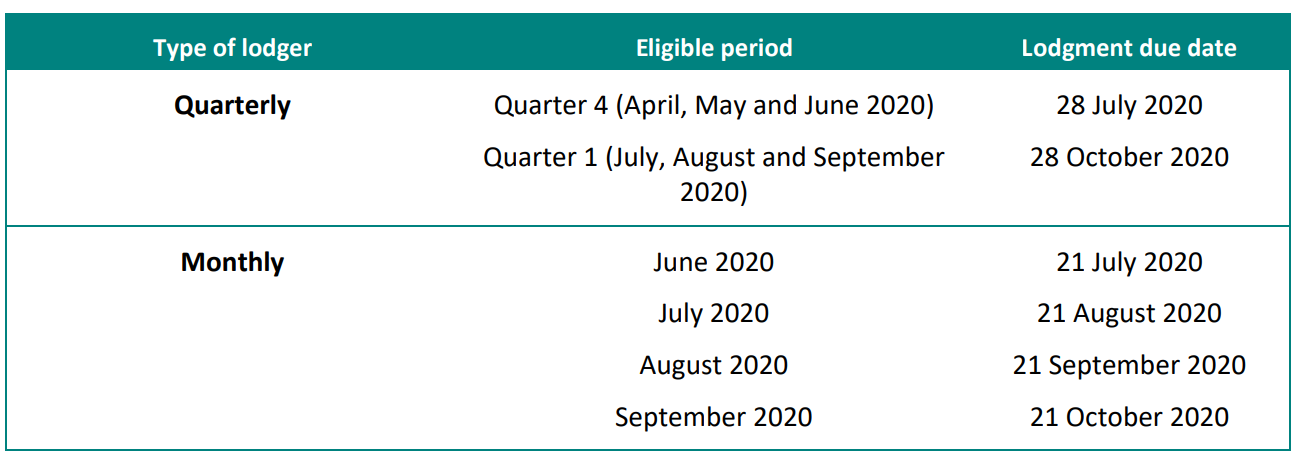

Timing – Additional payment

The additional payment will be applied to a limited number of activity statement lodgments. The ATO will deliver the payment as a credit to the entity upon lodgment of their activity statements. Where this results in the entity being in a refund position, the ATO will deliver the refund within 14 days.

Quarterly lodgers will be eligible to receive the additional payment for the quarters ending June 2020 and September 2020. Each additional payment will be equal to half of their total initial Boosting Cash Flow for Employers payment (up to a total of $50,000). Monthly lodgers will be eligible to receive the additional payment for the June 2020, July 2020, August 2020 and September 2020 lodgments. Each additional payment will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment (up to a total of $50,000).

Examples

Sarah’s Construction Business

Sarah owns and runs a building business in South Australia and employs 8 construction workers on average full-time weekly earnings, who each earn $89,730 per year. Sarah reports withholding of $15,008 for her employees on each of her monthly Business Activity Statements (BAS). Under the Government’s changes, Sarah will be eligible to receive the payment on lodgment of her BAS. Sarah’s business receives:

- A credit of $45,024 for the March period, equal to 300 per cent of her total withholding.

- A credit of $4,976 for the April period, before she reaches the $50,000 cap.

- No payment for the May period, as she has now reached the $50,000 cap.

- An additional payment of $12,500 for the June period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the July period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the August period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the September period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

Under the previously announced Boosting Cash Flow for Employers measure, Sarah’s business would have received a maximum payment of $25,000. Under the Government’s enhanced Boosting Cash Flow for Employers measure, Sarah’s business will receive $100,000. This is an additional $75,000 to support her business and help her retain her staff.

Sean’s Hairdresser Salon

Sean owns a hairdresser’s salon on the Gold Coast. He employs 12 hairdressers, with average salary of $50,000 per year. Sean reports withholding of $8,788 for his employees in each of his monthly BAS.

Under the Government’s changes, Sean will be eligible to receive the payments on lodgment of his relevant BAS. Sean’s business will receive:

- A credit of $26,364 for the March period, equal to 300 per cent of his total withholding.

- A credit of $8,788 for the April period.

- A credit of $8,788 for the May period.

- A credit of $6,060 for the June period, before he reaches the $50,000 cap.

- Sean will also receive an additional payment of $12,500 for the June period, equal to 25 per cent of his total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the July period, equal to 25 per cent of his total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the August period, equal to 25 per cent of his total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the September period, equal to 25 per cent of his total.

Under the previously announced Boosting Cash Flow for Employers measure, Sean’s business would have received a total payment of $25,000. Under the Government’s enhanced Boosting Cash Flow for Employers measure, Sean’s business will receive $100,000. This is an additional $75,000 to support his business.

Tim’s Courier Run

Tim owns and runs a small paper delivery business in Melbourne and employs two casual employees who each earn $10,000 per year. In his quarterly BAS, Tim reports withholding of $0 for his employees as they are under the tax-free threshold. Under the Government’s changes, Tim will be eligible to receive the payment on lodgment of his BAS. Tim’s business will receive:

- A credit of $10,000 for the March quarter, as he pays salary and wages but is not required to withhold tax.

- An additional payment of $5,000 for the June quarter, equal to 50 per cent of his total Boosting Cash Flow for Employers payments.

- An additional payment of $5,000 for the September quarter, equal to 50 per cent of his total Boosting Cash Flow for Employers payments.

If Tim begins withholding tax for the June quarter, he will need to withhold more than $10,000 before he receives any additional payment. Under the previously announced Boosting Cash Flow for Employers measure, Tim’s business would have received a total payment of $2,000. Under the Government’s enhanced Boosting Cash Flow for Employers measure, Tim’s business will receive $20,000. This is an additional $18,000 to support his business.

Help for the Homeless Op-Shop

Help for the Homeless, a registered charity, runs an op-shop to support its programs and employs 5 part-time workers with an average income of $30,000 per year. It reports total withholding of $3,510 for its employees for each quarterly BAS. Under the Government’s changes, Help for the Homeless will be eligible to receive the payment on lodgment of its BAS as it is a charity. Help for the Homeless receives:

- A credit of $10,000 for the March quarter, the minimum payment.

- An additional payment of $5,000 for the June quarter, equal to 50 per cent of its total Boosting Cash Flow for Employers payments.

- An additional payment of $5,000 for the September quarter, equal to 50 per cent of its total Boosting Cash Flow for Employers payments.

Under the Government’s enhanced Boosting Cash Flow for Employers measure, Help for the Homeless will receive $20,000. Under the previously announced Boosting Cash Flow for Employers measure, NFPs were not eligible for the support.

SUPPORTING APPRENTICES AND TRAINEES

Summary

The Government is supporting small business to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer. Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter). Support will also be provided to the National Apprentice Employment Network, the peak national body representing Group Training Organisations, to co-ordinate the re-employment of displaced apprentices and trainees throughout their network of host employers across Australia.

Eligibility

The subsidy will be available to small businesses employing fewer than 20 full-time employees who retain an apprentice or trainee. The apprentice or trainee must have been in training with a small business as at 1 March 2020. Employers of any size and Group Training Organisations that re-engage an eligible out-of-trade apprentice or trainee will be eligible for the subsidy. Employers will be able to access the subsidy after an eligibility assessment is undertaken by an Australian Apprenticeship Support Network (AASN) provider. This measure will support up to 70,000 small businesses, employing around 117,000 apprentices.

Timing

Employers can register for the subsidy from early April 2020. Final claims for payment must be lodged by 31 December 2020. Further information is available at:

- The Department of Education, Skills and Employment website at: www.dese.gov.au.

- Australian Apprenticeships website at: www.australianapprenticeships.gov.au.

For further information on how to apply for the subsidy, including information on eligibility, contact an Australian Apprenticeship Support Network (AASN) provider.

Examples

David’s Plumbing

David’s Plumbing is a small business that employs 10 people, including two full-time Australian Apprentices. Taylor is a first year Australian Apprentice, aged 20, undertaking a Certificate III qualification. She commenced her apprenticeship with David’s Plumbing on 6 February 2020. Taylor receives a weekly wage of $532.89. Lisa is a third year Australian Apprentice, aged 29, undertaking a Certificate IV qualification. She commenced her apprenticeship with David’s Plumbing on 18 November 2017. She receives a weekly wage of $772.71. David’s Plumbing are eligible for Supporting Apprentices and Trainees which pays 50 per cent of the apprentices’ wages that have been paid by David’s Plumbing since 1

January 2020. David’s Plumbing will receive:

- $9,059 subsidy for employing Taylor from 6 February 2020 to 30 September 2020; and

- $15,068 subsidy for employing Lisa from 1 January 2020 to 30 September 2020.

For more information

For more information on the Australian Government’s Economic Response to the Coronavirus visit www.treasury.gov.au/coronavirus Businesses can visit www.business.gov.au/ to find out more about how the Economic Response complements the range of support available to small and medium businesses.